by Christina Neill

January 16, 2019

A Forrester Wave or Magic Quadrant just published. You sigh in relief and pat yourself on the back for another job accomplished. But if you’re like us, it’s not too long before the question starts to creep in – how do we do better next year?

No matter if you and the analyst author are entirely in sync, or if there are discrepancies in your beliefs, rest is short-lived in AR. Year over year, we have to determine where an analyst agrees with us and where we have differences – and then plan our strategy accordingly.

It’s unlikely you and an analyst see your category’s landscape exactly the same. While it’s always nice to get credit from analysts for things that you think you’re great at, it’s a little frustrating if you don’t get credit for the other things.

From our experience, we’ve found that vendors typically encounter three scenarios with analysts:

So what is your strategy for forward momentum in each of these situations? How do you close the gap between what you believe and what the analyst sees?

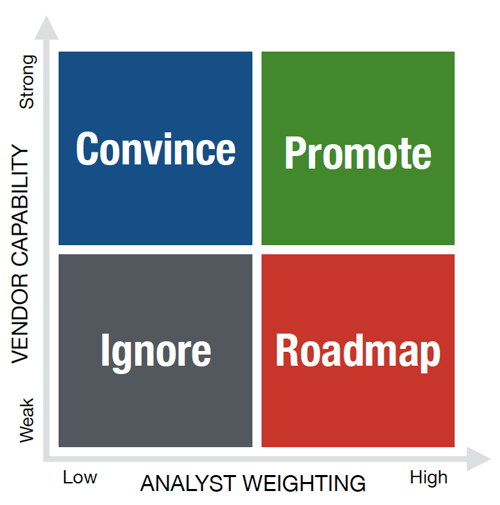

When our clients reach impasses like this with a key analyst, we use a positioning model to think through the similarities and differences between what we believe and what the analyst believes.

Depending on where things land, we recommend that our clients may need to adjust their messaging, their interaction type, their tonality, their spokesperson and even their resource material. Making these strategic adjustments can help them win the conversation moving forward.

As you can see, this model helps reconcile the analyst’s view of the world and what they value compared to a vendor’s offerings. Knowing how the analyst views the world mapped to your strengths, will help you identify what your engagement strategy should be for the next evaluation report.

We dive deeper into this positioning model in our on-demand webinar, Planning AR Activity with Context and Purpose (Part 2). Check it out and learn more about how you can use this tool.

How do you determine where you stand with analysts? Tell us below.